Inequality and Insecurity in Retirement: New report from Boston Indicators highlights racial gaps in retirement savings and access

June 5, 2024

Boston – New research from Boston Indicators, the research center of the Boston Foundation, co-authored with Jeffrey Thompson and Hope Bodenschatz of the Federal Reserve Bank of Boston, finds differences in access and availability of retirement plans play a significant role in perpetuating wealth gaps in Massachusetts and nationally.

The new report, Inequality and Insecurity in Retirement: Racial Disparities in Retirement Plan Coverage, Assets and Adequacy in the U.S. and Massachusetts, paints a fuller picture of retirement assets as an element of wealth, exploring the data when possible by race and age. It finds stark racial differences in the level of access to retirement accounts and the amount of retirement assets in those accounts., paints a fuller picture of retirement assets as an element of wealth, exploring the data when possible by race and age. It finds stark racial differences in the level of access to retirement accounts and the amount of retirement assets in those accounts.

“Retirement savings plans are a critical element of building household wealth for families, and the data suggest that when available, pensions and retirement accounts are among the most equally distributed assets available, meaning they could be a critical part of reducing racial wealth gaps,” said Luc Schuster, Senior Director of Boston Indicators. “Unfortunately, lower-income households and households of color – the households that lag on many measures of wealth – are less likely to have access to retirement plans, or the funds to put in them.”

In the report, researchers first augment national data from the Survey of Consumer Finances to include estimates of the value of defined-benefit (DB) pension plans to get a fuller picture of retirement assets. Including these pension plans, the research finds that employment-based retirement assets are the largest source of wealth for families approaching retirement age, for middle-wealth families, and particularly for Black families, with retirement plan assets accounting for more than 40 percent of all private assets for Black households with heads ages 40 to 64.

Notably, data show pensions are among the most equally distributed private assets by race, particularly when comparing Black and White households. The average White household with a direct benefit pension holds $268,921 in that plan, versus $207,329 for Black households, a ratio of 1.3-to-1. For direct contribution plans, like 401(k) plans, the ratio is 4.4-1. Unfortunately, the analysis also finds that while 61% of White households have retirement plan coverage from one or both partners, whereas just 52% of Black and 34% of Latino households have plans.

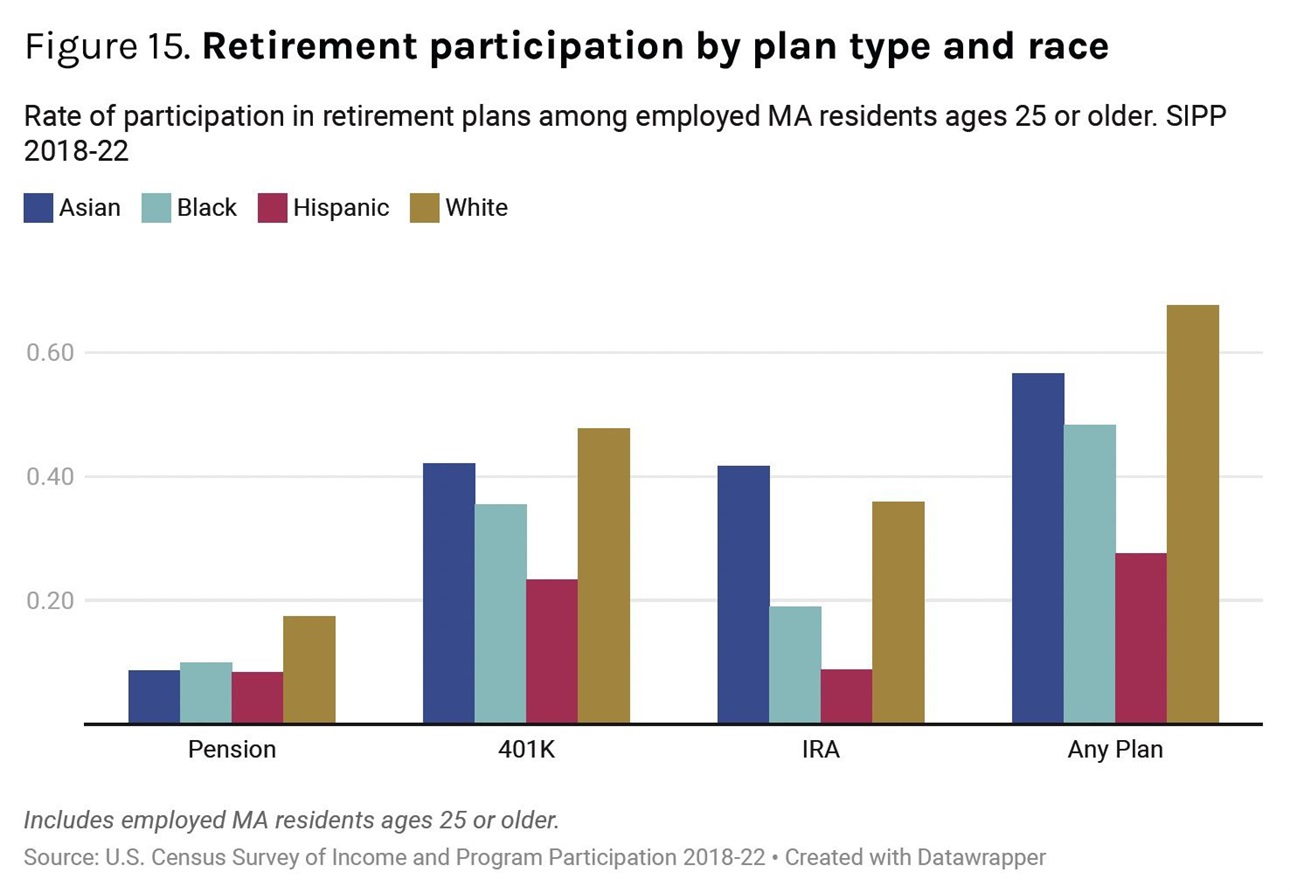

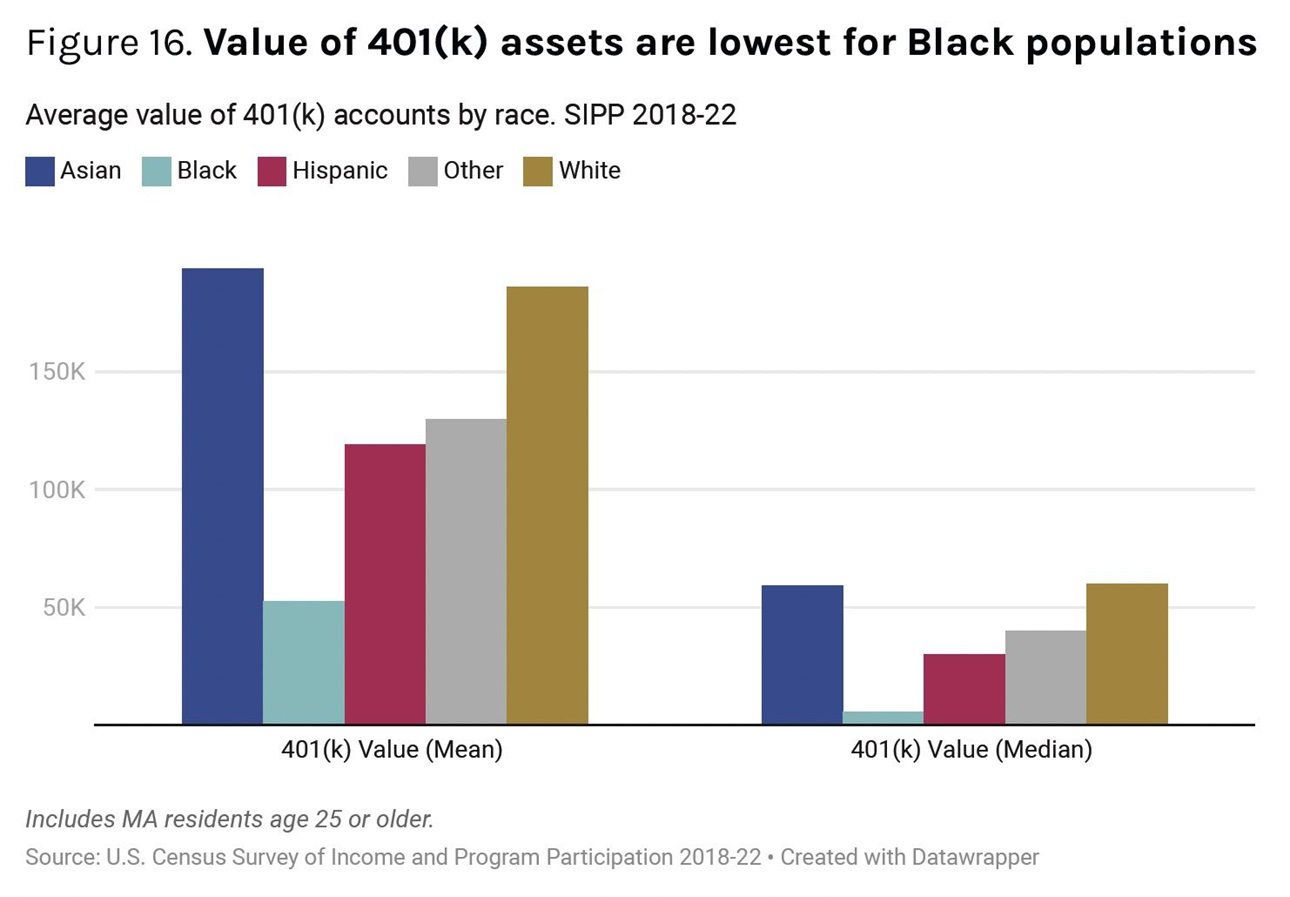

The report then delves more specifically into retirement security data in Massachusetts, finding that White and Asian workers are more likely to participate in most types of retirement plans than Black and Latino workers and, on average, have the highest levels of 401(k) assets. However, the racial gaps are lower than they are for many other types of assets. The data show that Hispanic/Latino workers have the lowest levels of retirement plan participation. The research also shows that retirement savings gaps are smaller for workers in public sector jobs, and that retirees with traditional direct-benefit pensions – either public or private sector – are more likely to have greater economic security in retirement.

One notable access gap – in addition to the racial gaps – is one of income. Workers in high-paying jobs (over $78,000/year) are substantially more likely to have access to a retirement plan than workers earning less than $50,000 per year.

The gaps in retirement asset value between racial groups are often driven by sharp differences in retirement plans such as 401(k)s and IRAs. White and Asian workers are twice as likely as Black and Latino workers to have IRAs, and while the participation gap narrows for 401(k) participation, White and Asian workers have much higher mean and median savings in their 401(k) plans.

What could be done?

The final part of the report examines policy options for increasing coverage, boosting plan balances, and – also necessary – ensuring the fiscal viability of public and private pension plans. An estimated 57 million private sector employees have no access to employer-based retirement plans. In Massachusetts, a proposed IRA-style plan called Secure Choice would provide opportunities for employees without access to an employer-based plan. Other options include ensuring that all workers understand the options available to them and enhancing things like the portability of retirement plan assets between employers, which is currently left to the wherewithal of the worker.

To boost assets, the report highlights research that suggests automatic enrollment in retirement plans makes it 20 times more likely that employees will save, and that default contribution rates ease the process for workers. Federal tax credits could also increase the tax benefits of retirement saving for lower-income workers. Lastly, policies that support the critical role of pensions in reducing wealth gaps, especially by addressing the fiscal health of plans that face longer-term funding problems, are needed to safeguard the retirement security of participants. However, the report does not delve deeply into those solutions, noting that “Policy conversations over fund adequacy have focused primarily on contribution rates, details of benefit formulas, and, to a lesser extent, investment rules and strategies.”