The Power of Non-Cash Gifts

The Smart Way to Maximize Your Philanthropy

THE BOSTON FOUNDATION DIFFERENCE

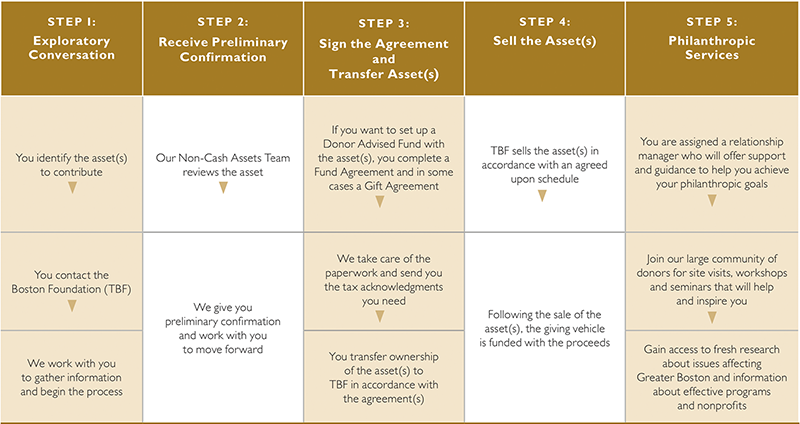

When non-cash assets are transferred to a fund at the Boston Foundation, they can be sold without incurring capital gains taxes and the proceeds can be directed to charity. Many donors liquidate non-cash assets, such as appreciated securities or restricted stock, to support their favorite nonprofits or causes—in the process diminishing the power of their gift.A non-cash transaction with the Boston Foundation is a smart approach that benefits you and the causes you care about, and assures that you will be supported throughout the entire giving process.

The Boston Foundation offers direct access to our highly experienced Non-Cash Assets Team. No bureaucracy. No waiting for approvals from management. Instead, from your initial inquiry, you will work with our most senior staff and receive thoughtful, meticulous, personalized service. We stand ready to provide philanthropic support to you after the transaction to ensure that your goals are achieved.

WHAT TYPES OF ASSETS DO WE ACCEPT?

- Publicly traded securities

- Restricted stock

- Privately held interests (C-Corp and S-Corp stock, limited partnerships or LLCs)

- Private equity interests

- Real estate

- IRAs, retirement accounts

- Miscellaneous or unique assets (patents, mineral rights, royalties)

- Whole life insurance policies, annuities

HOW DO YOU BENEFIT?

- Tax deductions: Gifts of appreciated securities and other long term capital gain property to a Boston Foundation fund are generally eligible for a full fair market value deduction for income and gift tax purposes.

- Greater impact: Because the non-cash assets are sold by the Boston Foundation, they generally do not generate capital gains taxes. As a result, you have more resources to direct to the causes you are passionate about.

- Access to philanthropic expertise: Whether you are just beginning your philanthropic journey or possess a high level of clarity and sophistication, our relationship managers will sit down with you to discuss your ideas, values and the issues that are most important to you. In addition to being welcomed into our vibrant donor community, you will have access to workshops and events designed to equip you with the information and tools you need to maximize the impact of your philanthropy. Boston Foundation staff members have deep knowledge of local nonprofits working to solve some of our region’s biggest problems. They also have strong relationships with other community foundations across the country and with international philanthropy, thereby providing you with support whether you make grants locally, nationally or internationally.

- Online support: We provide easy fund services and expert grant-making assistance.

How can you get started?

Contact our Senior Vice President & Chief Philanthropy Officer, Kate Guedj, CAP®, at Kate.Guedj@tbf.org or call 617.338.2670 to discuss the assets you would like to transfer.

Note: The Boston Foundation and its staff do not provide legal, tax, or financial advice. Donors should seek their own legal, tax and financial advice in connection with gift and planning matters.