Donor Advised Funds

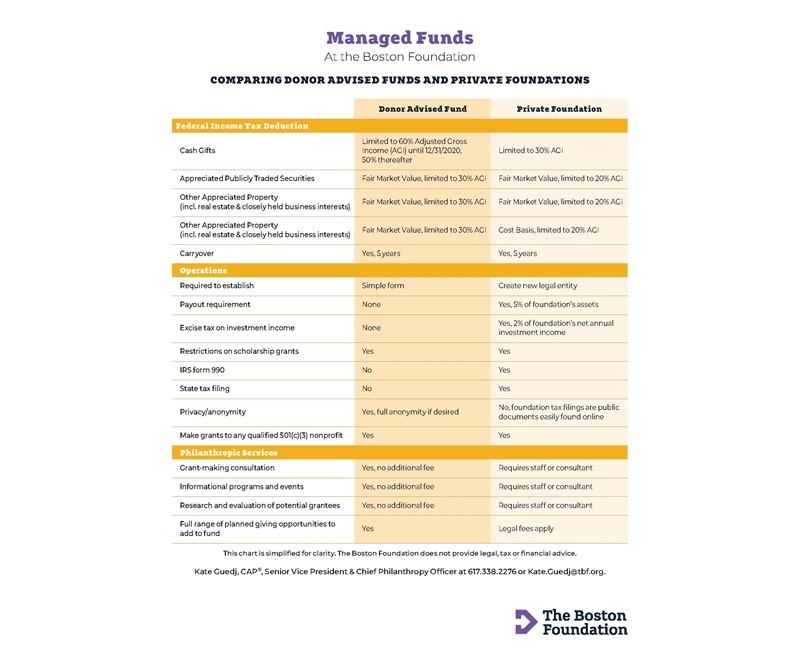

A Donor Advised Fund (DAF) is a charitable giving vehicle created by an individual, family or organization. It offers an immediate tax benefit and allows you to make grants over time to nonprofit organizations of your choosing. You can establish a fund at the Boston Foundation with a gift, which is immediately tax-deductible, and then use it and its growth over time to donate to qualified nonprofits anywhere in the world. Donor Advised Funds can be a sensible alternative to private foundations, providing flexible giving strategies with minimal overhead for you as a donor.

Gifts to a Boston Foundation DAF may be made in the form of cash, stock, real estate or other non-cash assets, such as S-stock or personal property. When you transfer non-cash assets to a Donor Advised Fund properly, they can be gifted without incurring capital gains taxes, allowing 100 percent of the proceeds to be given to charity. You can add to or replenish your funds at any time, with no minimum requirement for additional contributions.

As a DAF advisor, you will have access to our top-notch Donor Portal, allowing you to see your Fund’s balance and make grants at any time. You can also work with your dedicated relationship manager to help meet and advance your philanthropic goals, and you may name your children or other family members as successors to your donor advised fund through a simple succession plan form.

Why a Boston Foundation DAF?

The Foundation was founded in 1915 for one purpose: to receive gifts from generous donors and to use those resources to make grants to the nonprofit organizations meeting the needs of Boston-area residents every day. Today, while many of our donors care deeply about Boston and Massachusetts, their philanthropy often extends to national and even global concerns. Grants from DAFs can be made to any qualified charity in the United States or abroad, and we have experience working with donors on this.

The Boston Foundation compares very favorably with commercial gift funds; we urge you to compare advantages. The fees we charge for administering Donor Advised Funds go directly to our operating budget, not to a for-profit bottom line. Boston Foundation DAF holders are therefore helping to fund independent research into the region’s most pressing issues, and supporting our special initiatives and civic leadership activities.

Through the Permanent Fund for Boston, the Boston Foundation makes millions of dollars in grants each year to Greater Boston nonprofits, giving us unparalleled in-depth knowledge of the organizations working every day to address the region’s most pressing challenges. Donors are encouraged to attend Foundation-sponsored events, educational programs and other opportunities to gain a deeper understanding of important problems and the strategies being employed to solve them.

We offer four investment options for your funds, with investment strategies aligned with the anticipated time frame of the fund, as well as access to established SRI indexes and our customized Impact Pool.

Working with You

When you open a Donor Advised Fund at the Boston Foundation, you’ll be matched with a dedicated Donor Services liaison to discuss your giving goals, help you identify and evaluate nonprofit organizations and programs, connect you with other fundholders who share your philanthropic interests, create a plan that involves your family in your grantmaking, and consider the future of your fund. With the added resources of The Philanthropic Initiative, we can help you define a focus for your giving or build a grants management program.

Getting Started

Establishing a Donor Advised Fund at the Boston Foundation is quick and easy. You may download and print a fund agreement. Our Donor Services staff is also happy to help. Please call the Office of Development and Donor Services at 617-338-2213 or e-mail any questions you might have.

You establish a fund at the Boston Foundation with a minimum gift of $10,000, which is tax deductible, and then use it to make grants when and as you wish. You may recommend grants to any qualified 501(c)(3) public charity or operating foundation in the United States and to international organizations with the same status, subject to the Foundation’s standard due-diligence procedure. There is no minimum yearly grant requirement.